Will Ethereum Replace Bitcoin A Deep Dive into the Future

As will Ethereum replace Bitcoin takes center stage, this opening passage beckons readers into a world steeped in cryptocurrency discussions, where innovation meets investment. Both Ethereum and Bitcoin have carved their niches in the blockchain landscape, each serving unique purposes while embodying distinct technological advancements. Understanding these differences and the current market dynamics will help illuminate the potential future of these two influential cryptocurrencies.

This exploration delves into their origins, market trends, and technological innovations, providing a comprehensive look at how Ethereum is positioning itself in the shadow of Bitcoin. With the rise of decentralized finance (DeFi) and smart contracts, Ethereum is not just a currency but a platform for innovation, while Bitcoin remains a stalwart as a store of value. The discussion will unfold the implications of these factors on their respective futures.

Introduction to Ethereum and Bitcoin

Ethereum and Bitcoin are two of the most prominent cryptocurrencies in the digital landscape, each with unique characteristics that set them apart. Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, was primarily designed as a decentralized digital currency aimed at providing a peer-to-peer payment system. In contrast, Ethereum, launched in 2015 by Vitalik Buterin and a team of co-founders, was developed as a platform to facilitate smart contracts and decentralized applications (dApps).The fundamental difference between these two cryptocurrencies lies in their primary purposes.

Bitcoin functions mainly as a store of value, often referred to as "digital gold," while Ethereum serves as a robust platform that allows developers to build and deploy smart contracts, which automatically execute when certain conditions are met. Additionally, both cryptocurrencies introduced significant technological innovations: Bitcoin with its pioneering blockchain technology and Ethereum with its Turing-complete programming language, which enables complex contract execution.

Market Trends and Adoption Rates

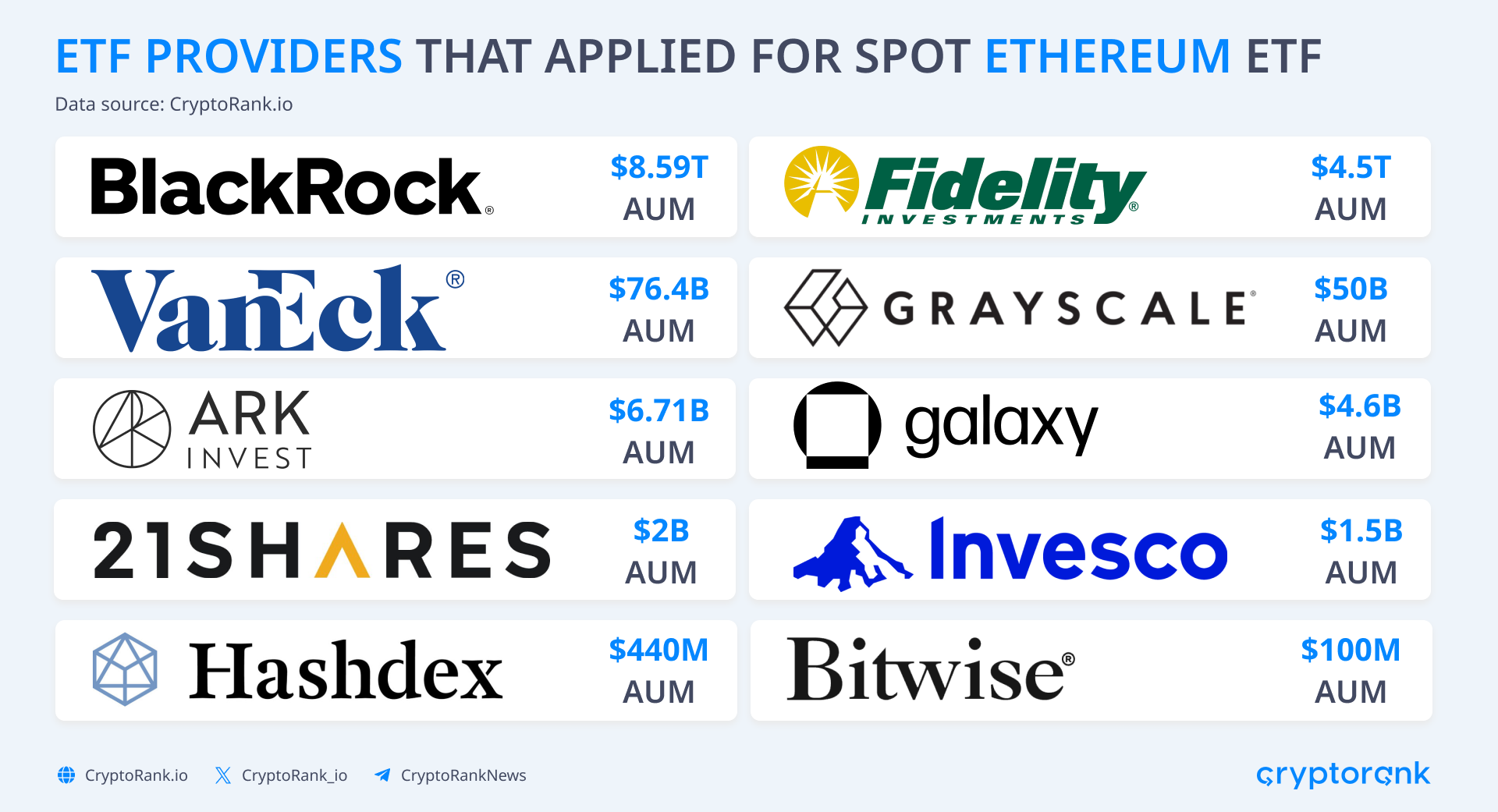

The market dynamics of Bitcoin and Ethereum reveal distinct trends in adoption and investment. As of late 2023, Bitcoin retains a dominant position in the market, accounting for approximately 40% of the total cryptocurrency market capitalization. Ethereum, however, has been gaining traction, holding around 20% of the market share. Over the past few years, the adoption rates of both cryptocurrencies have surged significantly, driven by increased interest from retail investors and institutional players.Institutional investments have notably influenced Ethereum's growth.

Major financial institutions and investment firms have begun to recognize Ethereum's potential for decentralized finance (DeFi) applications, leading to increased capital inflow. This shift in institutional focus may foreshadow a more substantial adoption of Ethereum as it evolves into a leading platform for various financial services.

Technological Advancements

One of Ethereum's standout features is its implementation of smart contracts, which revolutionize the way agreements are executed without intermediaries. Unlike Bitcoin's more straightforward blockchain technology, Ethereum's smart contracts allow for intricate programmable transactions, enhancing utility in diverse sectors such as finance, gaming, and supply chain management.The introduction of Ethereum 2.0 is another significant milestone, focusing on improving scalability and sustainability through the transition from proof-of-work to proof-of-stake consensus mechanisms.

This upgrade is expected to decrease energy consumption and increase transaction throughput. Numerous innovative projects built on Ethereum, such as Uniswap and Chainlink, demonstrate its potential to reshape industries, attracting developers and entrepreneurs looking to leverage its capabilities.

Use Cases and Real-World Applications

Ethereum's real-world applications highlight its advantages over Bitcoin in various contexts. For instance, Ethereum plays a central role in the DeFi space, enabling users to lend, borrow, and trade assets without traditional financial intermediaries. This utility contrasts with Bitcoin's primary use case as a store of value, where its value proposition lies in its scarcity and security.Transaction speeds and costs also differ significantly between the two.

While Bitcoin transactions can take longer to confirm, especially during peak network activity, Ethereum typically offers faster transaction processing times, making it more suitable for applications requiring immediate execution. However, it's worth noting that Ethereum's transaction costs, known as gas fees, can surge during high demand, occasionally leading to challenges for users.

Community and Ecosystem

The communities supporting Ethereum and Bitcoin are vital to their ongoing development and adoption. Ethereum boasts a vibrant developer community, continuously innovating and creating new tools and applications that enhance its ecosystem. In contrast, Bitcoin's development focuses more on maintaining its original protocol, emphasizing security and stability over rapid changes.Regarding governance models, Ethereum employs a more flexible approach, allowing for community discussions and proposals through a process known as Ethereum Improvement Proposals (EIPs).

Bitcoin's governance, however, is more conservative, prioritizing consensus among a smaller group of developers. Notable partnerships, such as Ethereum's collaboration with major enterprises like Microsoft and JPMorgan, further enrich its ecosystem, showcasing its potential for real-world integration compared to Bitcoin.

Regulatory Considerations

The evolving regulatory landscape significantly impacts both Ethereum and Bitcoin. Currently, regulations surrounding cryptocurrencies vary widely across jurisdictions, affecting market perceptions and investor confidence. Bitcoin has often been perceived with skepticism due to its association with illicit activities, while Ethereum's utility in DeFi has attracted attention from regulators focusing on consumer protection.Future regulations may further shape Ethereum's rise as governments worldwide seek to establish clearer guidelines for digital assets.

As regulations evolve, they could enhance public trust in cryptocurrencies while also influencing investment flows and adoption rates. The need for clarity and compliance in the burgeoning crypto space will be crucial in determining how both Ethereum and Bitcoin navigate their paths forward.

Future Predictions

Experts have begun to speculate on the potential for Ethereum to surpass Bitcoin in market capitalization and adoption. Factors that could accelerate Ethereum's growth include the expansion of DeFi applications, increased institutional investment, and successful implementation of Ethereum 2.0. Conversely, challenges such as regulatory hurdles and competition from other blockchain platforms could hinder its progress.Market sentiment and speculative forecasts suggest a growing recognition of Ethereum's capabilities.

As more users and developers flock to the Ethereum network, its value proposition may become more pronounced, potentially leading to a shift in the cryptocurrency hierarchy where Ethereum could rival or even exceed Bitcoin's dominance in the future.

Final Review

In conclusion, as we navigate the evolving landscape of cryptocurrencies, the question of whether Ethereum will replace Bitcoin is more than just speculation; it reflects broader trends in technology, market behavior, and community support. While Bitcoin continues to dominate as a digital gold, Ethereum's unique capabilities in facilitating decentralized applications and financial services may well allow it to carve out a significant place in this emerging financial ecosystem.

The future holds much promise, and keeping an eye on these developments will be essential for anyone involved in the cryptocurrency space.

Frequently Asked Questions

What are the main differences between Ethereum and Bitcoin?

Ethereum focuses on enabling smart contracts and decentralized applications, while Bitcoin primarily serves as a store of value.

How does Ethereum's market share compare to Bitcoin's?

As of now, Bitcoin retains a larger market share, but Ethereum has been gaining ground due to increased adoption in DeFi.

What role do institutional investments play in Ethereum's growth?

Institutional investments have significantly boosted Ethereum's visibility and credibility, driving its adoption for various applications.

Are there real-world applications of Ethereum that outshine Bitcoin?

Yes, Ethereum's smart contracts facilitate a range of applications in finance, gaming, and supply chain management that Bitcoin does not offer.

What future predictions exist regarding Ethereum's potential to surpass Bitcoin?

Experts suggest that if Ethereum continues to innovate and attract developers, it could potentially surpass Bitcoin in mainstream adoption and market capitalization.