btc and ethereum etf A Comprehensive Guide

btc and ethereum etf are reshaping the investment landscape, offering a bridge between traditional finance and the dynamic world of cryptocurrencies. These exchange-traded funds (ETFs) allow investors to gain exposure to the price movements of Bitcoin and Ethereum without directly holding the assets themselves.

Understanding the inner workings of these ETFs, their regulatory hurdles, and how they compare to traditional investments is crucial for anyone looking to navigate this evolving market. In this piece, we'll dive deep into the significance, challenges, and future potential of BTC and Ethereum ETFs.

Overview of BTC and Ethereum ETFs

Exchange-Traded Funds (ETFs) have emerged as a significant vehicle for investors looking to gain exposure to cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). These funds allow investors to buy shares that represent a collection of assets, providing a more accessible entry point into the often volatile cryptocurrency market. BTC and Ethereum ETFs have evolved significantly since their inception. The first Bitcoin ETF proposals were met with skepticism from regulators, primarily due to concerns about market manipulation and investor protection.

Nevertheless, persistence in the market led to the approval of several ETFs in various jurisdictions, paving the way for broader adoption. BTC and Ethereum ETFs function by tracking the price of their respective underlying assets. Investors can buy and sell shares of these ETFs on traditional stock exchanges, thus bypassing the need for cryptocurrency exchanges. Key features of these ETFs include real-time trading, liquidity, and the potential for diversification, which can mitigate some risks associated with direct cryptocurrency investments.

Regulatory Landscape

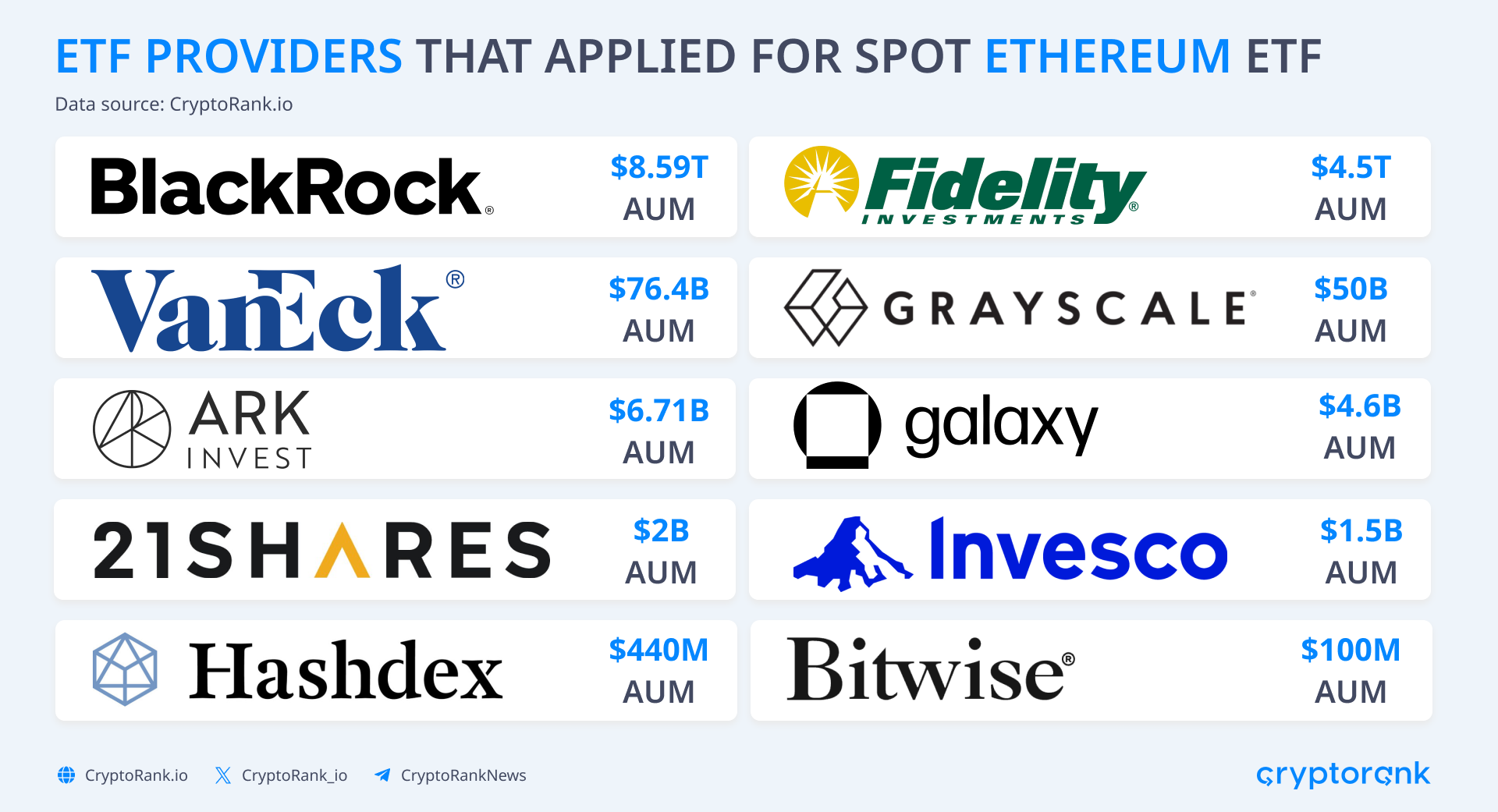

The regulatory environment surrounding BTC and Ethereum ETFs is complex and continually evolving. Different countries have adopted varied approaches to cryptocurrency regulation, leading to challenges in the approval processes. Regulatory bodies like the U.S. Securities and Exchange Commission (SEC) play a pivotal role in assessing and approving these funds. The SEC has been particularly cautious regarding Bitcoin and Ethereum ETFs, often citing concerns about market manipulation and the lack of investor protection.

This cautious stance has impacted the speed at which these ETFs could enter the market. The regulatory landscape significantly influences investor confidence and, subsequently, the performance of BTC and Ethereum ETFs.

Market Impact and Performance

When comparing the market performance of BTC and Ethereum ETFs to their underlying assets, a pattern often emerges. Generally, these ETFs tend to reflect the price movements of Bitcoin and Ethereum closely but can experience discrepancies due to management fees and market dynamics. Factors affecting the price volatility of these ETFs include shifts in investor sentiment, regulatory news, and macroeconomic trends.

For instance, during periods of bullish market activity for cryptocurrencies, BTC and Ethereum ETFs often see elevated trading volumes and price appreciation. Investor sentiment towards these ETFs is currently mixed, largely shaped by market conditions and ongoing regulatory discussions. As more institutional investors enter the space, the perception of BTC and Ethereum ETFs continues to evolve, influencing their market attractiveness.

Investment Strategies

Investing in BTC and Ethereum ETFs can be approached from various angles, catering to both short-term and long-term investors. Short-term strategies might include taking advantage of price fluctuations through active trading, while long-term investors may focus on holding these ETFs as part of a diversified portfolio.Benefits of investing in BTC and Ethereum ETFs include ease of access, liquidity, and the potential for capital appreciation.

However, risks such as volatility and regulatory changes should not be overlooked. For new investors looking to enter the cryptocurrency ETF space, consider these tips:

- Research the ETF's underlying assets and management structure.

- Diversify your investments to mitigate risks associated with cryptocurrency volatility.

- Stay informed about regulatory developments and market trends.

Technical Aspects

The technological framework behind BTC and Ethereum ETFs is closely linked to blockchain technology. These ETFs utilize blockchain to streamline processes, enhance transparency, and facilitate tracking. Smart contracts play a crucial role in the management of these ETFs, allowing for automatic execution of trades and management of assets. This technology ensures a level of efficiency and security that traditional financial products may lack.Trading volume significantly impacts the liquidity of BTC and Ethereum ETFs.

Higher trading volumes typically lead to better liquidity, enabling investors to enter and exit positions more easily, which is essential in a fast-paced market.

Comparison with Traditional Investments

When comparing BTC and Ethereum ETFs with traditional investment vehicles like stock ETFs and mutual funds, several differences emerge. BTC and Ethereum ETFs often exhibit higher volatility, which can lead to greater potential returns but also increases risk.Incorporating BTC and Ethereum ETFs into a traditional investment portfolio can offer diversification benefits, allowing investors to hedge against market downturns in conventional assets.

Unique selling propositions of BTC and Ethereum ETFs include their ability to provide exposure to the fast-growing cryptocurrency market without the need for direct investment in digital currencies. This can attract investors who are interested in crypto’s growth potential but are cautious about the complexities and risks of direct ownership.

Future Outlook

The future of BTC and Ethereum ETFs looks promising, with potential growth driven by increasing acceptance of cryptocurrencies in mainstream finance. Predictions suggest continued expansion of this investment vehicle as more regulatory clarity emerges.Technological advancements, such as enhanced blockchain solutions and better integration with traditional finance, could further stimulate the growth of cryptocurrency ETFs. Possible challenges for BTC and Ethereum ETFs include regulatory hurdles and competition from new financial products.

However, opportunities abound, particularly as institutional adoption rises, which could lead to greater market stability and increased investor confidence.

Last Recap

In summary, btc and ethereum etf represent a significant innovation in the investment world, blending the allure of cryptocurrencies with the structure of traditional ETFs. As regulatory environments evolve and market dynamics shift, these funds are likely to continue capturing investor interest, presenting both opportunities and challenges for the future.

FAQ

What is the primary advantage of investing in BTC and Ethereum ETFs?

The main advantage is that they provide exposure to these cryptocurrencies without the need for direct ownership, which simplifies the investment process and reduces risks related to security and storage.

How do BTC and Ethereum ETFs differ from directly buying cryptocurrencies?

ETFs allow for easier trading on stock exchanges and can be included in traditional investment accounts, while direct purchases require cryptocurrency wallets and can involve more complex storage and security measures.

What role does the SEC play in the approval of cryptocurrency ETFs?

The SEC evaluates applications for cryptocurrency ETFs to ensure they meet regulatory standards, focusing on investor protection and market transparency.

Can BTC and Ethereum ETFs help diversify an investment portfolio?

Yes, incorporating these ETFs can provide diversification benefits, as they are likely to behave differently than traditional asset classes, potentially reducing overall portfolio risk.

What should new investors consider before investing in BTC and Ethereum ETFs?

New investors should research the specific ETFs, understand the underlying assets, assess their risk tolerance, and consider market trends before making investment decisions.